Macroeconomics and financial markets

On the US New York stock market on November 30th, the Dow Jones Industrial Average closed 520 points (1.47%) higher than the previous day, while the Nasdaq index closed 32.2 points (0.23%) lower.

Buying in anticipation of the end of the Federal Reserve’s interest rate hike cycle continued as the U.S. personal consumption expenditure (PCE) price index showed slowing inflation, pushing the Dow to its highest level in 11 months.

Among crypto assets (virtual currency) related stocks, it was revealed that ARK Invest, led by Cathie Wood, sold 38,668 shares (equivalent to 750 million yen) of its Coinbase shares.

Coinbase stock rose 36.9% month-on-month, hitting a year-to-date high, boosted by expectations for a Bitcoin ETF (exchange-traded fund) to be listed and the resignation of the top executive of Binance, the largest crypto asset (virtual currency) that had been deprived of market share. prices were soaring.

ARK Invest sold 43,956 shares on November 27th to increase profits in Coinbase shares, while also buying up shares in Robinhood (HOOD), a major US investment app operator, seven times during November. Bought $1.5 million worth of SoFi Technologies (SOFI) for allocation to the ARK FinTech Innovation ETF.

connection:NY Dow hits new high this year; October PCE suggests slowing inflation | 1-day Financial Tankan

connection:Stock investment recommended for virtual currency investors, “10 representative virtual currency stocks in Japan and the United States”

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.38% from the previous day to 1 BTC = $ 38,000.

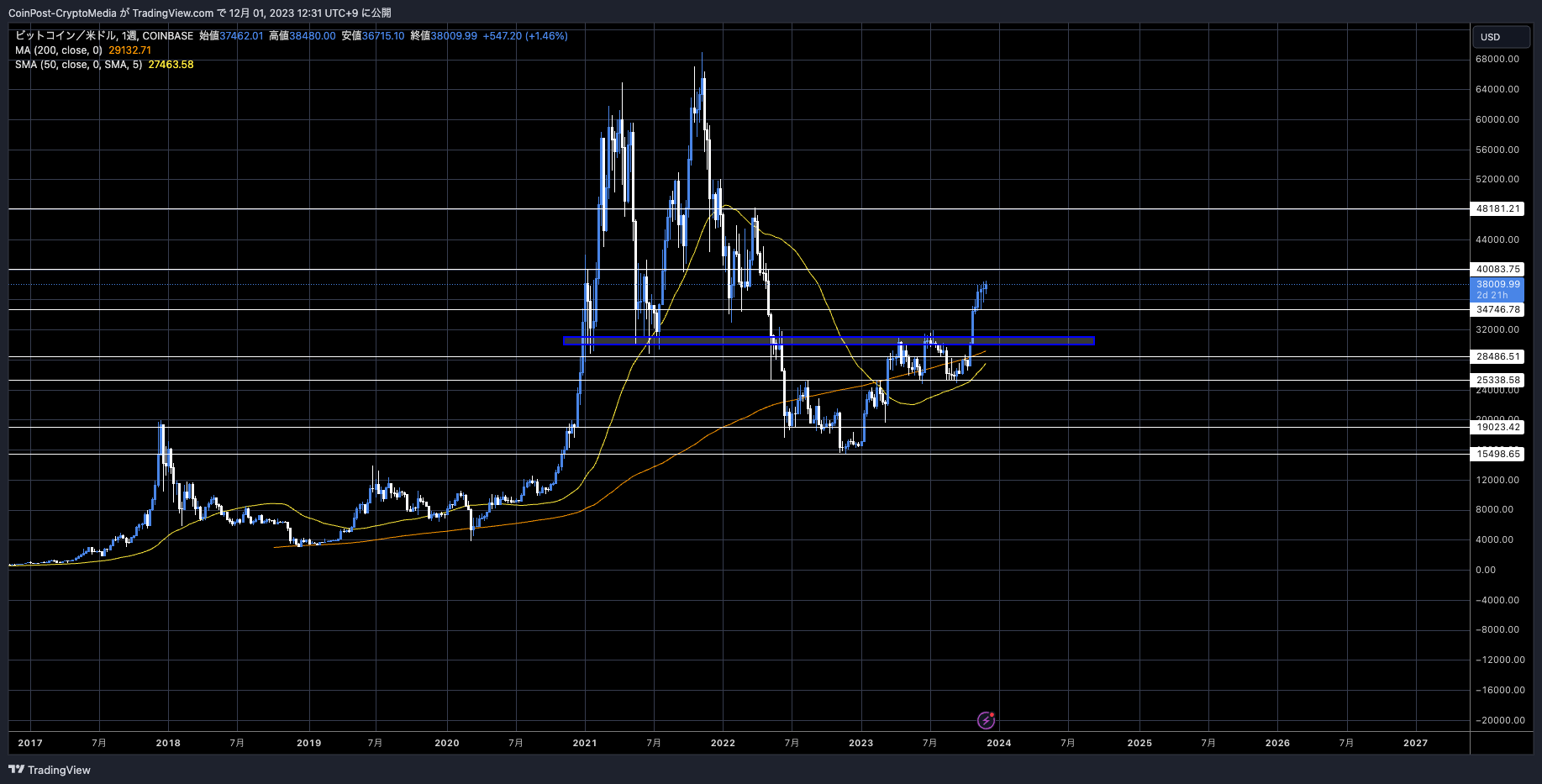

BTC/USD weekly

It is forming an ascending triangle on a daily basis, and if it breaks out, the psychological milestone of $40,000 will be within sight.

Among the major alts, Ethereum (ETH), which ranks second in market capitalization, rose 2.9% from the previous day, Lido Staked Ether rose 3.4%, and Dogecoin (DOGE) rose 3.1%.

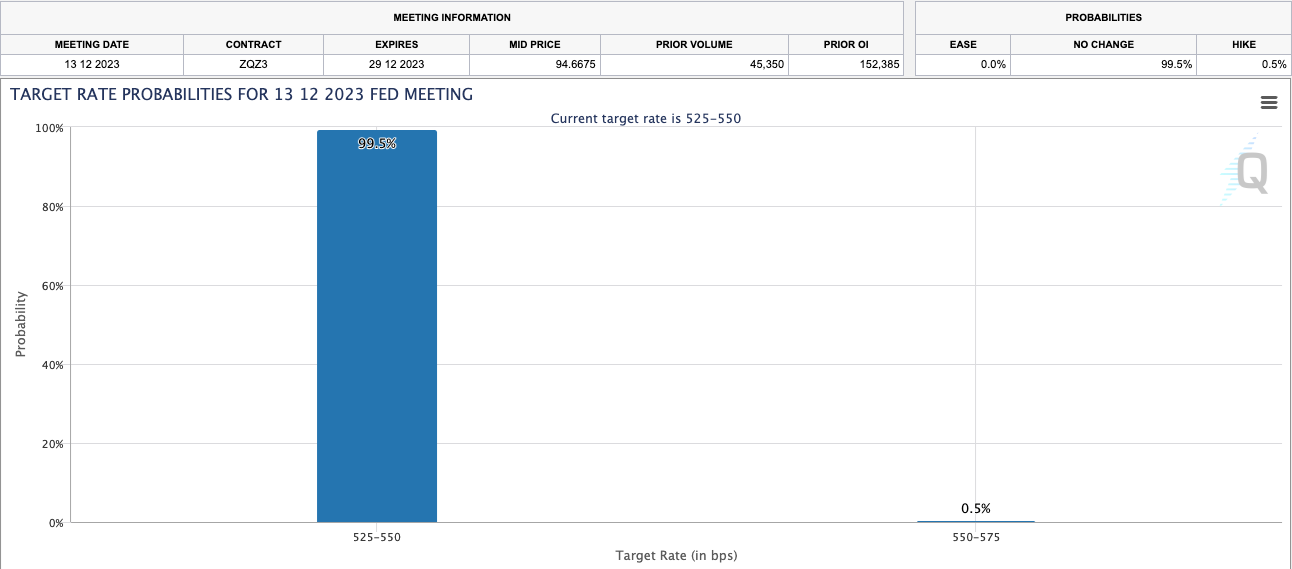

Some market participants see the dovish remarks of Christopher Waller, known for being a hawk, as a clear signal. (FOMC) 99.5% expect interest rates to remain unchanged.

CME FedWatch Tool

Michael Novogratz, CEO of US cryptocurrency investment company Galaxy Digital, has predicted that the US economy is expected to slow significantly as early as early next year, and that the Fed will cut interest rates by mid-2024. This is a tailwind for risky assets such as stocks and virtual currencies.

On the 30th, it was revealed that MicroStrategy, a US listed company, had purchased an additional 16,130 BTC (equivalent to $593.3 million). The collection period is from November 1st to November 29th.

MicroStrategy has acquired an additional 16,130 BTC for ~$593.3 million at an average price of $36,785 per #bitcoinAs of 11/29/23, @MicroStrategy now hodls 174,530 $BTC acquired for ~$5.28 billion at an average price of $30,252 per bitcoin. $MSTR https://t.co/hSEZyzGBsr

— Michael Saylor (@saylor) November 30, 2023

(@saylor) November 30, 2023

According to a prospectus filed with the Securities and Exchange Commission, MicroStrategy plans to raise up to $750 million in new stock (class A common stock sale) with Cowen and Company, Canaccord Genuity, and BTIG. We have concluded a contract to carry out the following.

MicroStrategy has been increasing its holdings since August 2020, when it announced that it would hold Bitcoin as a reserve asset, and its holdings and cumulative investment amount amounted to 174,530 BTC ($5.28 billion). According to Saylor Tracker, unrealized gains (excluding November purchases) amounted to approximately $1.2 billion.

connection:MicroStrategy buys approximately $600 million worth of virtual currency Bitcoin

The ProShares Bitcoin Futures ETF (BITO), which was launched in November 2021 in response to growing speculation about listing Bitcoin spot ETFs (exchange traded funds), has reached a record high of $1.47 billion in assets under management. reached.

All this #Bitcoin ETF hype has driven ProShares’ $BITO (Bitcoin Ffutures ETF) to a new all time high in assets. Closing in on $1.5 billion pic.twitter.com/b8advV1uGo

— James Seyffart (@JSeyff) November 29, 2023

It doubled in size in just one month, according to Bloomberg analyst Eric Balchunas.

connection:BITO, the first Bitcoin futures ETF in the U.S., hits record high in assets under management as institutional demand grows

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

On-chain data

According to Ali’s analysis, whales (large investors) bought up $90 million worth of Polygon (MATIC) in the week ending on the 29th.

#Polygon |Recently, $MATIC whales have been on a buying spree, scooping up over 120 million #MATIC in the past week – that’s a hefty $90 million investment! pic.twitter.com/uqXopGoqvy

— Ali (@ali_charts) November 29, 2023

On the other hand, according to a post by CryptoQuant analyst Quicktake, MATIC’s foreign exchange reserves, which are stored in the wallets of all virtual currency exchanges, have increased significantly even during the rebound from the recent correction phase, leading to selling pressure. suggests that it is not declining.

In September of this year, Polygon’s development team Polygon Labs announced the native token “POL” through the Polygon Improvement Proposals (PIP) proposal in “Polygon 2.0”.

The POL token upgrade is now live on Ethereum mainnet.

Polygon 2.0, released this summer, is a roadmap for scaling Ethereum to build the Value Layer of the Internet. POL unlocks that future.

POL is a next-generation token that can power a vast ecosystem of ZK-based L2 chains.… pic.twitter.com/gmrsu0ZqLz

— Polygon (Labs) (@0xPolygonLabs) October 25, 2023

Related: Polygon new currency “POL” to be deployed on Ethereum mainnet

Aiming to be a multi-purpose token that supports a vibrant ecosystem of layer 2 networks built on zero-knowledge proofs, preparations are underway to replace the currently circulating MATIC.

Bitcoin ETF special feature

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

Click here for a list of past market reports

The post Bitcoin returns to the $38,000 level, setting a new year-to-date high, reports continue on Bitcoin ETFs appeared first on Our Bitcoin News.

1 year ago

134

1 year ago

134

English (US) ·

English (US) ·