Funds flowing into US-regulated BITO

The assets under management of BITO, the first Bitcoin futures ETF introduced in the United States, reached $1.47 billion (217 billion yen) on November 28, 2021, around the peak of the previous bull market. This surpassed the previous high of $1.44 billion set in January.

The ETF, managed by ProShares, tracks the CME Bitcoin futures market and is believed to be the world’s largest Bitcoin futures ETF, based on data from Bloomberg.

Source: YCharts

BITO was launched in October 2021, and the trading volume on the first day was approximately $1 billion (approximately 150 billion yen), the largest ETF trading volume ever. On the second day, assets under management reached $1 billion.

BITO subsequently expanded its assets under management to $1.42 billion in just one month after its launch. However, due to the prolonged bear market in the crypto asset (virtual currency) market and the bankruptcy of exchange FTX.com, the fund’s assets declined to approximately $500 million in November 2022.

Net inflows into BITO this year reached $438 million as of Nov. 24, according to ETF.com. As of October 12, 2023, BITO had $850 million in assets under management, with an inflow of $224 million in the two weeks ending November 10.

The rise in market value is also influencing the increase in BITO’s assets under management. The current Bitcoin (BTC) price is approximately 5,567,462 yen at the time of writing, and has increased approximately 130% in the past year and approximately 48% in the past 90 days.

“BITO’s success shows the demand for an easy and regulated way to access Bitcoin,” Simeon Hyman, global investment strategist at ProShares, told CoinDesk. .

Increased institutional demand for Bitcoin

In the United States, there are limited Bitcoin trading options available to institutional investors, so BITO and the CME Bitcoin futures market, which is the basis of BITO, are prone to inflows of funds from institutional investors who place emphasis on compliance requirements. situation.

Some believe that BITO’s assets under management could be halved if the first physical Bitcoin ETF in the United States is approved and launched.

It should be noted that BITO invests in Bitcoin futures and does not invest directly in Bitcoin itself. “In the first year, assets and trading volume will be cut in half,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence.

connection:Bitcoin investment products experience net inflows for 9th consecutive week, the largest since the “bull market” in November 2021

Source: Coinshares

Expectations are rising for the listing approval of a physical Bitcoin ETF, and the fact that Bitcoin itself has hit a new high since the beginning of the year is also attracting institutional money.

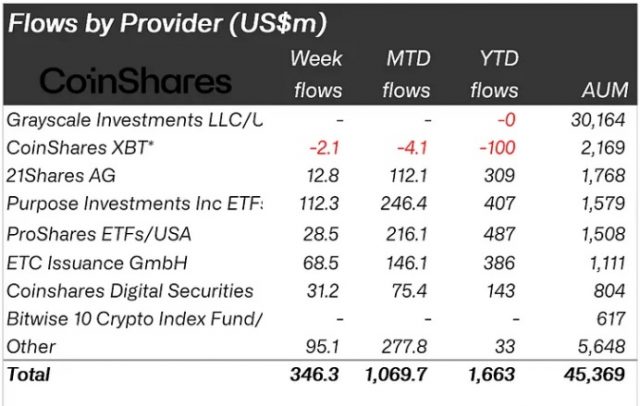

Funds have also flowed into other crypto investment products, and according to a weekly report from asset management firm CoinShares, capital flows from institutional investors have been net inflows for the ninth consecutive week through the fourth week of November, totaling It reached $346 million.

Due to the combination of Bitcoin (BTC) price increases and capital inflows, total assets under management (AUM) has expanded to $45.3 billion (approximately 6.6 trillion yen), the highest level in the past year and a half. By region, Canada and Germany accounted for 87% of this inflow.

connection:CME’s Bitcoin futures OI surpasses Binance for the first time

nhttps://imgs.coinpost-ext.com/uploads/2022/10/china_usa_bitcoin1.jpg -->

The post BITO, the first Bitcoin futures ETF in the U.S., hits record high in assets under management as institutional demand grows appeared first on Our Bitcoin News.

1 year ago

88

1 year ago

88

English (US) ·

English (US) ·