Macroeconomics and financial markets

In the US NY stock market on the 7th, the Dow Jones Industrial Average rose 91 dollars (0.27%) from the previous day, and the Nasdaq Index closed 171 points (1.29%) lower.

connection:AI/IT stocks fall due to speculation of additional US interest rate hike in July Arc buys more Coinbase stocks | 8th Financial Tankan

The US consumer price index (CPI) on the 13th and the US Federal Open Market Committee (FOMC) on the 14th are about to be announced, and the Nasdaq index, which had renewed its high since the beginning of the year, is selling, and the wait-and-see trend has strengthened.

Contrary to market expectations, the Bank of Canada raised interest rates by 0.25% (25bp) for the first time in three meetings against the backdrop of persistently high inflation, leading to bond selling and the yield on US 10-year government bonds rising.Blackout period now

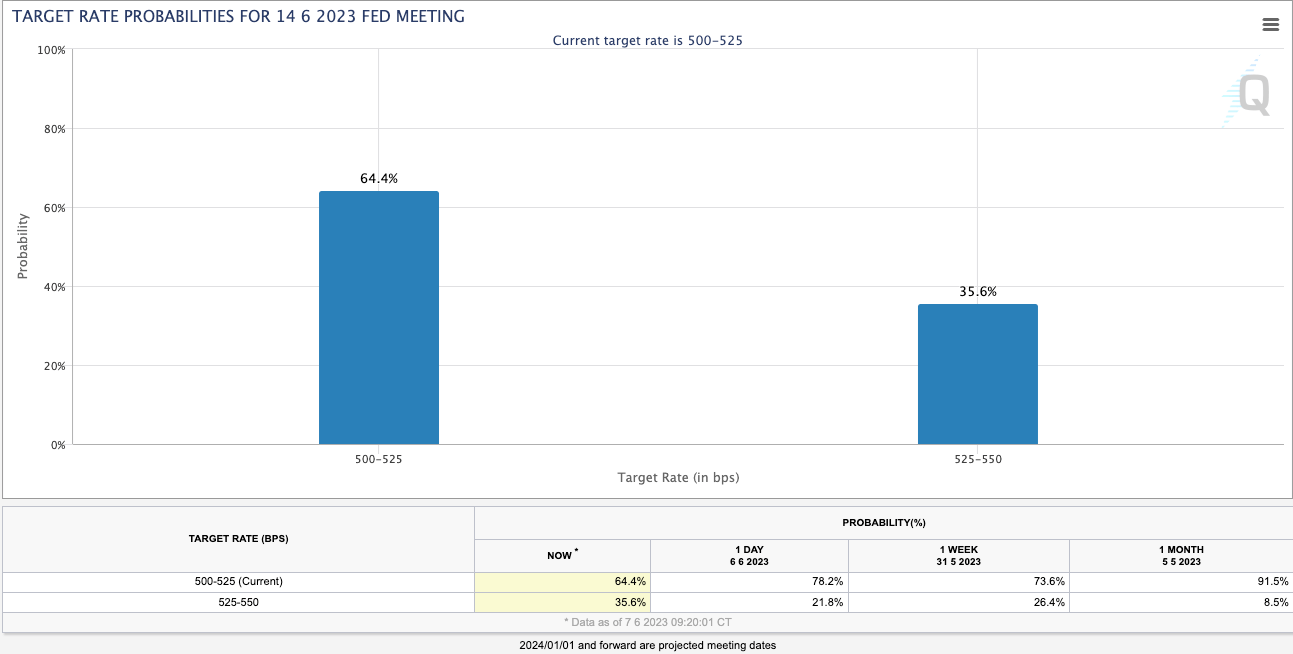

In response to this, in the futures interest rate market, expectations that the FRB (US Federal Reserve System) policy interest rate will remain unchanged (suspend rate hikes) after the next FOMC will drop to 64.4%. Expectations for another 25bp rate hike increased by about 14% from the previous day.

CME FedWatch Tool

A month ago, more than 90% of the market expected a halt to rate hikes, but with changes in economic indicators and statements from senior FRB officials, the market’s sense of caution is rising again. If the additional rate hike continues, it will be negative for risk assets such as stocks and crypto assets (virtual currency). The stock market has risen due to the fact that the suspension of interest rate hikes has been factored in, and there is a risk that the stock market will turn to a risk-off trend.

The Tokyo stock market, which has rapidly renewed post-bubble highs, such as the Nikkei Stock Average surpassing 32,000 yen, is preparing for the “Major SQ (Special Clearing Index Calculation),” which overlaps stock index futures and options trading this Friday. Volatility (price volatility) may increase.

With the market falling sharply from the highs and forming a shadowy foot with trading volume, speculation is likely to intensify for the US FOMC and the monetary policy meeting on the 15th and 16th of next week. The trend of overseas speculators, who have driven the Japanese stock market, such as net buying over the past few weeks, is also attracting attention.

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.81% from the previous day to $26,392.

After the cryptocurrency plummeted when the U.S. SEC (Securities and Exchange Commission) filed a lawsuit against Binance was reported, long futures were wiped out. It seems to have stalled at the resistance line at the upper end of the range.

As a result, the price movement is seen as if the long and short positions are burned on both sides, and it can be said that it is an adverse effect of the recent decline in liquidity.

connection:SEC Coinbase Lawsuit also Rebounds Bitcoin Significantly, Full Recovery of Binance Shock Decrease

The BTC price, which had fallen sharply to 1 BTC = $16,600 at the beginning of the year, has since rebounded. Although it touched $31,500 in mid-April, it fell back as it was blocked by major resistance zones. In the subsequent correction phase, the pair has been stuck in a descending channel, with both the top and bottom prices making downward moves.

There is a risk that the $25,300 cut will be pushed to $21,500 (②). If the upper end of the range is broken by the body of the candlestick and the stock rises to $28,500 (①), the flow of the market may change, but the FOMC and CPI results are not very favorable as the headwinds from the US regulatory authorities are increasing. As far as I can tell, it won’t be easy.

BTC/USD daily

SEC increasing pressure

Binance.US was sued by the U.S. SEC (Securities and Exchange Commission) on the 5th, delisting more than 100 currency pairs such as AXS/USDT, ATOM/USDT, MANA/BTC, and institutional investment. Announced a temporary suspension of OTC trading for homes.

Binance’s native token, BNB, fell 7.5% from the previous day, and Ada (ADA) fell to 6.67 on concerns that further declines in liquidity in the crypto-asset (virtual currency) market could exacerbate the sluggish market. 50% drop, and Solana (SOL) 8.66% drop, especially for tokens certified as securities, selling is ahead of the curve.

Binance.US said, “The suspension may be lifted in the next few weeks to months. We will notify users when it becomes available again.” deposits and withdrawals will continue to work.”

connection:Binance US to discontinue mass currency pairs

Stablecoins such as Bitcoin, Ethereum, and USDT traded on Binance.US were traded at a premium price that was several percent higher than the market price. It shows that investors are rushing to withdraw.

In the background, the SEC asked the court for permission to place a “temporary injunction” against the assets of Binance .US and its affiliates (BAM Management US Holdings, BAM Trading Services) to protect customers.

On June 5, the SEC sued Binance for selling unregistered securities and operating an unregistered exchange in the United States. It claims that 13 cryptocurrencies, including Solana (SOL) and Polygon (MATIC), fall under securities and investment contracts.

connection:US SEC sues Binance and CZ, claiming many cryptocurrency stocks as securities

On the other hand, Coinbase CEO Brian Armstrong and Chief Legal Officer Paul Grewal, who filed a lawsuit on the following day, said that they had already provided legally compliant staking services and had not been certified as a securities company. He said he was not thinking about delisting the tokens that were delisted.

Over the years, Nasdaq-listed Coinbase has asked the SEC to present transparent rules and guidelines to clarify “which digital assets should be classified as securities.” It is said that he did not respond sufficiently.

Under the pretense of protecting investors, criticism has been directed at taking the hard line of “sue”, which has a large impact on the market, while drawing a vague line.

Meanwhile, the decentralized exchange Uniswap, which has attracted investor interest as a haven, saw a 41% increase in daily trading volume. PancakeSwap’s trading volume is also skyrocketing.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Crypto Market Severe Price Movement Continues Aftermath of Binance Coinbase Lawsuit by SEC appeared first on Our Bitcoin News.

2 years ago

163

2 years ago

163

English (US) ·

English (US) ·