Public chain utilization

Daiwa Securities Group Inc. announced on November 30th that it will issue a security token (ST) on a public blockchain and conduct a proof of concept (POC) for the development of an issuance platform.

The platform utilizes the blockchain of the crypto asset (virtual currency) Ethereum (ETH). The implementation is scheduled to begin after January 2024, and this time the test will mainly examine how customers’ assets can be protected in the event of hacking.

This POC will be conducted by four companies in collaboration with the company’s subsidiaries Daiwa Securities, Fintertech, and Ginco. The POC is based on the fact that STs issued in Japan are mainly based on private chains and consortium chains, but overseas they are also issued on public blockchains.

connection: European Investment Bank (EIB) to issue digital bonds worth 13 billion yen on Ethereum

He explained that although there are various issues in utilizing public blockchains, there are benefits such as high transparency and interoperability, which led to the decision to conduct this POC. If this happens, it will be the first such case in Japan to date.

Overview of POC

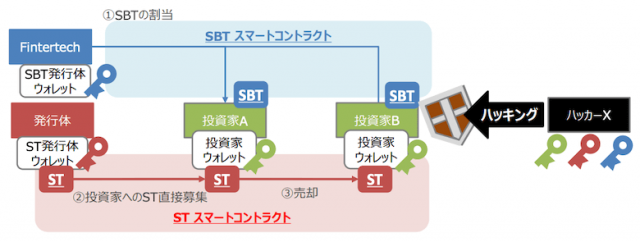

In this POC, Fintertech first granted Soulbound Tokens (SBT) to the addresses of two investors on Ethereum. After that, the issuing company issues ST on Ethereum.

What is SBT?

A non-transferable token with characteristics that cannot be transferred outside the digital wallet once received. Use cases include recording personal credit-related data such as qualifications, work history, project contributions, user credentials, and loan history.

Virtual currency glossary

Virtual currency glossary

This ST will be sold to a single investor through a small private placement without involving a securities company. The investor who bought it will then sell it to another investor.

Through smart contracts, this ST is designed so that only investors who own SBT can acquire and sell it. By utilizing this design, it should be possible to prevent unauthorized transfer of ST even if the private key is leaked by hacking.

The company also plans to demonstrate how smart contracts can prevent problems or restore the original state when problems occur in the following three cases.

- If an investor’s encryption key is stolen

- If the issuer’s encryption key is stolen

- If the SBT issuer’s encryption key is stolen

Source: Announcement

The roles of each company in POC are as follows.

- Daiwa Securities: Oversight, planning, organizing and finalizing considerations

- Fintertech: SBT issuance, technical advice and verification

- Ginco: System environment construction, technical advice and verification

connection: Pafin, a provider of crypto asset-related service “Cryptact”, talks to collaborate with Daiwa Securities Group Headquarters

About ST

ST is also called “digital securities,” and refers to digital assets that represent rights that are considered securities as tokens. In Japan, the Financial Instruments and Exchange Act (FIEA) was revised in May 2020, making it possible to handle ST in accordance with the law.

ST is expected to have the potential to solve problems with the traditional financial system and provide a more accessible and transparent system.

For example, last month, Tokyo Governor Koike announced that the city would support the promotion of fintech, including support for issuance of ST. He said he would promote financial digitalization to spread innovative technology to society.

connection: Governor Koike: “We will support the promotion of fintech, including support for the issuance of digital securities (ST).”

Digital securities special feature

The post Daiwa Securities and Ginco collaborate to issue digital securities (ST) on Ethereum appeared first on Our Bitcoin News.

1 year ago

63

1 year ago

63

English (US) ·

English (US) ·