Ethereum price resumed its downward trend this week as odds of Donald Trump winning next week’s general election retreated. Ether fell to $2,500, a few points below this week’s high of $2,725.

Donald Trump’s odds of winning

Ethereum and other cryptocurrencies have retreated sharply in the past few days as Polymarket data showed that Trump’s odds of winning the election fell to 62% on Friday, down from this week’s high of $67%. Kamala Harris odds have moved to 38%.

The same trend has happened in other markets. His odds on Kalshi have dropped from 62% to 56%, while PredictIt’s odds have moved to 55%.

While Trump has a lead towards the general election, the trend is not moving in the right direction.

At the same time, traders realize that this election may move in either direction since official polls are tight. Data from the New York Times shows that all swing states are within the margin of error.

Polls have been wrong in the past. For example, most of them gave Hillary Clinton a higher chance of winning in the 2016 election. They also showed that Republicans would have a clean sweep during the mid-term elections.

Therefore, there is still uncertainty about what will happen in the next election. This also explains why Trump-themed assets have dived. The Trump Media & Technology stock has plunged by over 35% from its highest level this month.

Similarly, Trump cryptocurrencies like MAGA, TREMP, and Trumpcoin have all crashed by double-digits in the past few days.

Bitcoin and Ethereum prices do well when there are higher chances of Donald Trump winning the election in the US. Besides, he would be the first president with crypto holdings, which Arkham estimates are worth almost $6 million.

Trump has also pledged to fire Gary Gensler and appoint a crypto-friendly head of the Securities and Exchange Commission (SEC).

However, the reality is that the role of a president in the crypto and stock market is relatively overestimated. Besides, Ethereum and Bitcoin soared to their record highs during Joe Biden’s presidency.

Ethereum ETF inflows are struggling

Ethereum price remains in a deep bear market as data shows that its ETF inflows are not doing all that well.

Data shows that Ether ETFs had net inflows of $13 million on Oct. 31st, higher than the $4.36 million on Wednesday and $7.65 million a day earlier. Altogether, these funds have had net outflows of over $480 million since their inception.

There are signs that investors are now more focused on Bitcoin ETFs, which are firing on all cylinders. Their inflows have soared to over $24.21 billion this year, a trend that may continue in the foreseeable future.

The iShares Bitcoin ETF now has over $26 billion and is closing the gap with the iShares Gold ETF (IAU), which has $33 billion in assets. This is notable since IBIT was launched this year, while the IAU was launched in 2005.

Ethereum is losing market share

At the same time, there are signs that Ethereum has weak fundamentals, which explains why its performance is lagging.

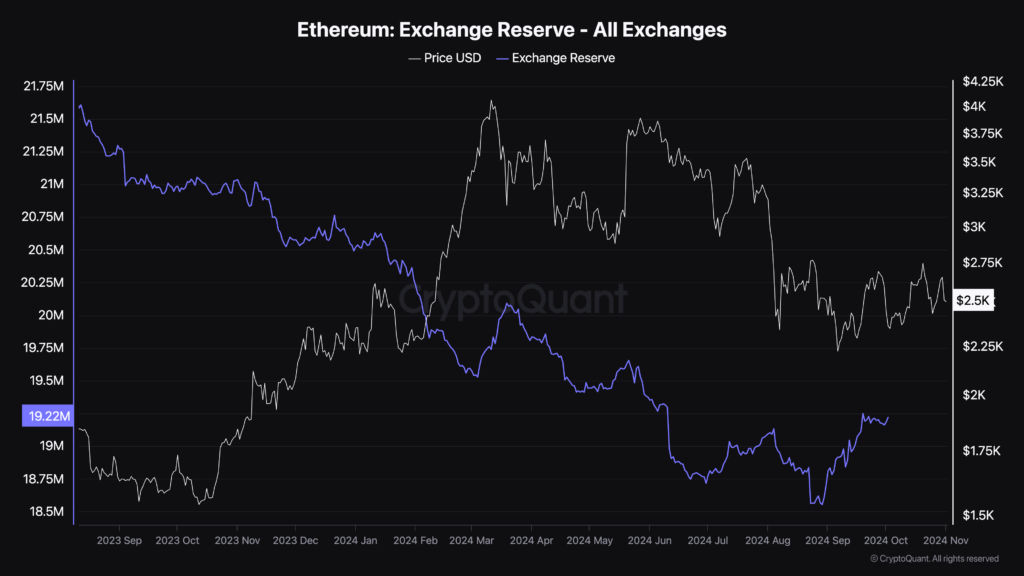

First, as shown below, the amount of Ethereum in exchanges has increased in the past few weeks, which is a sign that some investors are selling their coins. These exchange reserves rose to 19.5 million, its highest level since July, and much higher than the year-to-date low of 18.65 million.

ETH reserves | Source: CryptoQuant

At the same time, Ethereum is losing market share across industries like NFT and decentralized finance (DeFi).

Data compiled by CryptoSlam shows that Ethereum NFT sales dropped by over 34% in October to $119 million. That decline was much worse than the 27% and 23% drop in Bitcoin and Solana.

The total value locked (TVL) in Ethereum rose by 5% in October to $48 billion. In contrast, Solana’s TVL jumped by 11%, while Base soared by 12% to $2.45 billion.

What is notable, however, is in the DEX industry, where Solana handled transactions worth $52 billion, while Ethereum had $41 billion. The biggest networks in the Solana network were Raydium and Orca.

Ethereum price weak technicals

ETH chart by TradingView

The daily chart shows that the price of Ethereum has remained under intense pressure in the past few days.

Unlike Bitcoin, it has remained below the 50-day and 100-day Exponential Moving Averages, meaning that bears are in control.

Ethereum has moved to the 61.8% Fibonacci Retracement point. Most importantly, it has formed a bearish pennant pattern, which is made up of a long line and a symmetrical triangle pattern.

Therefore, there is a rising possibility that the coin will have a strong bearish breakout since the triangle is nearing its confluence level. If this happens, the next point to watch will be at $2,117, its lowest point in August.

Read more: Ethereum price prediction: risky pattern points to a breakdown

The post Ethereum price prediction: bad technicals, meet weak fundamentals appeared first on Invezz

English (US) ·

English (US) ·