- While crypto assets such as Ethereum have risen more than 10% since the beginning of the year, NFT prices have lagged behind.

- Officials and analysts say practicality and technology development are needed to bring about growth.

While crypto assets (virtual currencies) are inching closer to bull market territory, NFTs (non-fungible tokens) have not been able to benefit from the market’s euphoria.

Ethereum (ETH) has risen about 70% since the beginning of the year, but NFT valuations have not followed suit. Nansen’s NFT-500 index, which measures the value of the top 500 NFTs, has fallen 50% since the beginning of the year in ETH and 16% in dollars.

(Nansen.ai)

(Nansen.ai)The Blue-Chip 10 index, which measures the valuations of some of the most prominent NFTs, including CryptoPunks and Bored Ape Yacht Club, is down 44% in ether and 1.7% in dollars.

(Nansen.ai)

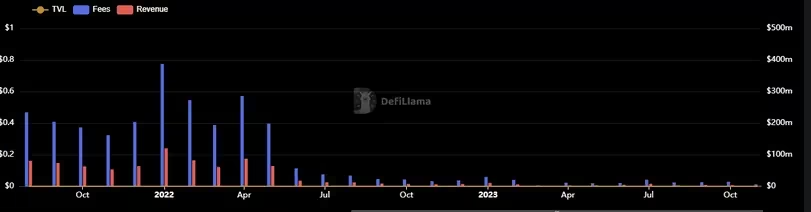

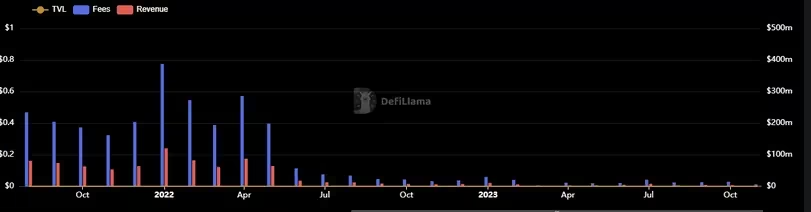

(Nansen.ai)OpenSea, the largest NFT marketplace, hasn’t fared as well. According to DeFiLlama data, in January 2022, at the height of NFT mania, the platform settled fees of 387.48 million dollars (approximately 58 billion yen, equivalent to 1 dollar = 150 yen) per month, and 120.45 million dollars per month. It generated revenue of 10,000 dollars (approximately 18 billion yen). Currently, fees have fallen to $6 million (approximately 900 million yen) a month, and revenue has fallen to $1.39 million (approximately 200 million yen).

(DeFiLlama)

(DeFiLlama)“NFTs have survived the first market cycle, but Uniswap “As DeFi experienced with AMM in 2017, we have yet to reach a new technological breakthrough to further drive user interest.” “Many new innovations are still being built to increase the use cases for NFTs, but the fact that NFT prices are generally negatively correlated to Ethereum prices also plays a role.” .

However, there are signs of growth in the market, with the market for NFTs based on utility rather than Monkey JPEG expanding, and the technology being applied to ticket sales, loyalty programs, etc.

Bitcoin (BTC) Ordinals also continues to grow in popularity as miners value high fees. Jason Fang of Sora Ventures said the company’s success is due to it becoming a hub for something like Layer 2 of the Bitcoin blockchain that is being developed.

“Bitcoin Ordinals is not only a groundbreaking Bitcoin utility, but also a hub that brings the community together,” Huang said in an email. “Communities like Stacks, BSV, Rootstock, and Starkware that don’t normally interact with each other are exploring ways to participate and build on the Ordinals protocol.”

David Mirzadeh, ecosystem finance lead at Taiko, says this utility is also a driving force behind the NFT rebound.

“We see NFTs regaining some of the ground they lost as they move from being just speculative JPEGs to assets with utility in areas such as gaming, music, and social,” he said. “Until then, NFT price performance will be largely driven by speculative hype and mania.”

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Lemon OpenSea Website

|Original text: NFT Prices Are Still Lagging Behind Ether’s Gains

The post NFTs have not kept up with Ethereum’s rise | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

70

1 year ago

70

English (US) ·

English (US) ·