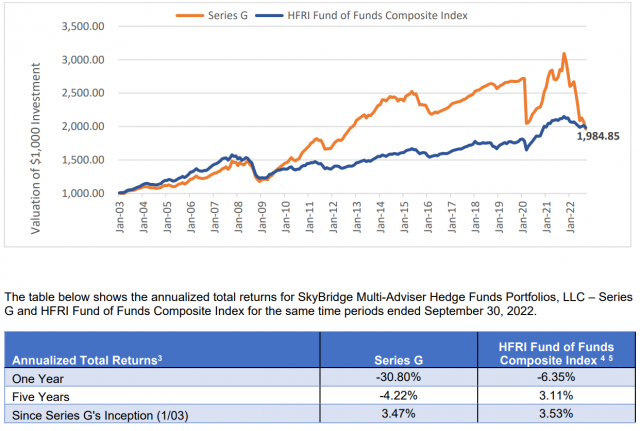

SkyBridge’s 22-year operational performance

A Bloomberg report on the 27th revealed that the core fund of SkyBridge Capital, a major US hedge fund that also has exposure to crypto assets (virtual currency), had a minus 39% performance in 2022.

“SkyBridge Multi-Adviser Hedge Fund Portfolios” is SkyBridge’s core fund that invests in stocks, crypto assets (virtual currency) funds, ETFs, etc. As of the end of September 2022, client assets under management (AUM) were reported at ¥169 billion ($1.3 billion).

Anonymous sources said there was an increase in customer redemption requests through the second half of 2022, but also noted that SkyBridge only redeemed funds below its pre-requirements.

Investors, who are now limited to twice-yearly redemptions, had asked to withdraw 60% of the fund’s capital during the Sept. 30 redemption period, but SEC (U.S. Securities and Exchange Commission) filings in January Only 10% were reimbursed, according to the report.

In addition, the redemption conditions of the fund will become stricter in the future. “We previously accepted requests for 25% reimbursement of cash four times a year,” but for the March 31 redemption span, we plan to meet redemptions not exceeding 5%,” the report said.

A representative for SkyBridge did not respond to Bloomberg’s request for an interview.

Fund investee

Source: Skybridge

According to filings with the SEC as of the end of September 2022, the annual return of “SkyBridge Multi-Adviser Hedge Fund Portfolios (Series G)” was negative 30.8% at that time, but the latest reports have widened the loss range further. Looking good.

Also, in the same document, you can check the breakdown of the fund’s portfolio. Investments labeled “b” that can be redeemed four times a year have a total capital of 100.9 billion yen, which is equivalent to just 60% of the fund’s capital (101.4 billion yen). The breakdown is as follows.

- Brevan Howard Digital Asset Multi-Strategy Fund, LP ClassB: $111,957,910 (14.5 billion yen: virtual currency)

- Multicoin Capital Offshore, SPC: $13,947,121 (1.8 billion yen: virtual currency)

- Coatue Offshore Fund Ltd Class M-6: $26,020,176 (3.3 billion yen; stock)

- Soma Offshore Ltd.: $6,488,649 (840 million yen: shares)

- Axonic Credit Opportunities Fund LP: $62,967,374 (8.1 billion yen: event-driven)

- Axonic Credit Opportunities Overseas Fund, Ltd.: $61,991,558 (8.1 billion yen: event-driven)

- Third Point Offshore Fund, Ltd.: $170,111,961 (22 billion yen: event-driven)

- Millennium International, Ltd.: $53,795,491 (6.9 billion yen: investment fund)

- Point72 Capital International, Ltd.: $272,562,330 (35.4 billion yen: investment fund)

Other investees have separate lock-up clauses and redemption accounts. For example, as of the end of September 2010, the only investment destination (label “d”) that can be redeemed twice a year was “Polychain Global Ltd: $7,945,257 (100 million yen: virtual currency)”.

As of the end of September 2010, the unpaid redemption amount for the entire fund was listed as 19.4 billion yen ($149,794,921).

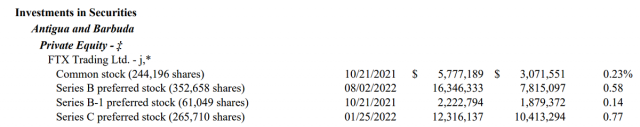

Capital relationship with FTX

Source: Skybridge

According to an SEC filing at the end of September 2022, SkyBridge has acquired shares in FTX Trading since 2021, but its exposure in the fund is around 1%.

SkyBridge founder Anthony Scaramucci and FTX founder Sam Bankman-Fried are friends, and in September 2010, FTX plans to acquire SkyBridge shares. SkyBridge has announced that it will purchase virtual currency with part of the raised funds (5.2 billion yen: 40 million dollars).

Relation:FTX Ventures Acquires 30% Stake in US VC Major SkyBridge

Shortly after FTX filed for bankruptcy protection in the United States in November 2022, Scaramucci said in an interview with CNBC that he was considering a stake buyback.

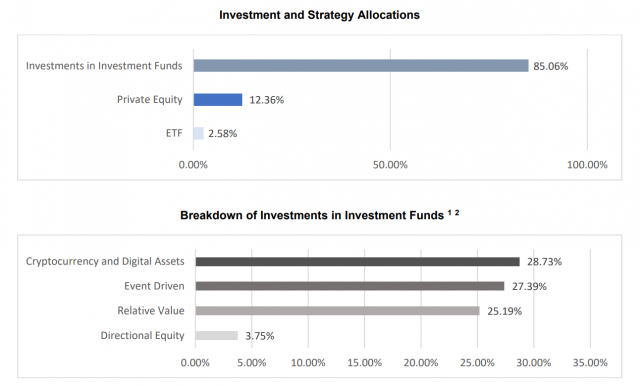

Source: Skybridge

Looking at the breakdown of “investment funds”, which account for 85% of SkyBridge’s main funds, “various virtual currencies” (Bitwise Ethereum Fund, NYDIG Institutional Bitcoin Fund, etc.) account for 28%, and “unlisted virtual currency companies” ( FTX, Genesis Digital Assets, Lightning Labs, etc.) accounted for 14% (as of the end of September 2022).

In addition to managing Bitcoin (BTC) and Ethereum (ETH) funds, SkyBridge raised approximately 900 million yen in April 2010 to launch the Bitcoin mining fund “SkyBridge BTC Mining LP.” He has also actively invested in the virtual currency market.

Scaramucci remains bullish on cryptocurrencies in an interview with CoinDesk on Jan. 18. Bitcoin’s 35% growth over the past 30 days is “near the bottom, not the new peak,” he said. “I encourage people to invest now.”

Relation:‘Not limited to Bitcoin’ SkyBridge Capital hints at potential cryptocurrency investments

The post SkyBridge, a major US venture capital, fell 39% last year: report appeared first on Our Bitcoin News.

2 years ago

119

2 years ago

119

English (US) ·

English (US) ·