March 31 (Friday) morning market trends (compared to the previous day)

- NY Dow: $32,859 +0.4%

- NASDAQ: $12,013 +0.7%

- Nikkei Stock Average: ¥27,782 -0.3%

- USD/JPY: 132.6 +0.01%

- USD Index: 102 -0.4%

- 10 year US Treasury yield: 3.5 -0.5% annual yield

- Gold Futures: $1,997 +0.6%

- Bitcoin: $28,106 -1.2%

- Ethereum: $1,793 -0.6%

traditional finance

crypto assets

Today’s NY Dow continued to rise and closed at +141 dollars. The Nasdaq also continued to rise to +87 dollars due to the buying dominance of IT and tech stocks. It seems that economic indicators that indicate a slowdown in inflation have become buying factors.

Last night’s quarterly real gross domestic product (GDP) rose 2.6% from a year earlier, below the median economist forecast of 2.7%. This is a downward revision from the revised 2.7% increase. US October-December quarter private consumption (confirmed value) rose 1.0%, a downward revision from the revised 1.4% increase.

In addition, the personal consumption expenditure (PCE) core price index, which the Federal Reserve Board (FRB) focuses on as an inflation indicator, increased by 4.4% annually from the previous quarter, slightly exceeding the revised 4.3% increase. In addition, corporate profits for the October-December quarter declined against the backdrop of rising interest rates, resulting in the largest negative since the fourth quarter of 2020. The effects of the Fed’s radical tightening of monetary policy, including four consecutive 0.75% interest rate hikes in 2022, are beginning to appear in the real economy.

In addition, the number of initial unemployment claims in the United States for the week ended 25th, announced last night, increased by 7,000 from the previous week to 198,000. Although the number of applications for unemployment insurance increased from the market forecast of 196,000, many pointed out that the unemployment rate was still low and the labor market was tight.

The PCE Core Deflator for February, the inflation gauge the Fed refers to, will be released tonight. The core PCE deflator is expected to increase by 0.4% month-on-month (up 0.6% in the previous month) and by 4.7% year-on-year (up 4.7% in the previous month).

Economic indicators (Japan time)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

- March 31, 23:00 (Friday): March University of Michigan Consumer Confidence Index, final figures

- April 3, 23:00 (Monday): March ISM Manufacturing Index

connection: Renewed the highest price of Bitcoin since the beginning of the year, XRP continued to rise sharply to 76.7 yen at one point

remarks by dignitaries

Richmond Fed President Thomas Barkin said in a speech on Thursday that inflation risks remain, according to Bloomberg, adding: “The challenge to assessing the current economic climate is the recent strong economic data and banking system. It’s a matter of how you adjust the weaknesses you get,” he said.

Minneapolis Fed President Neel Kashkari also said on the same day that the Fed “has more work to do” to bring inflation down to its 2% target, according to a Reuters report. While the Fed’s rate hikes so far have “made real progress” in curbing inflation, “the biggest concern right now is that the non-housing services economy shows no signs of slowing down.” pointed out.

US stocks

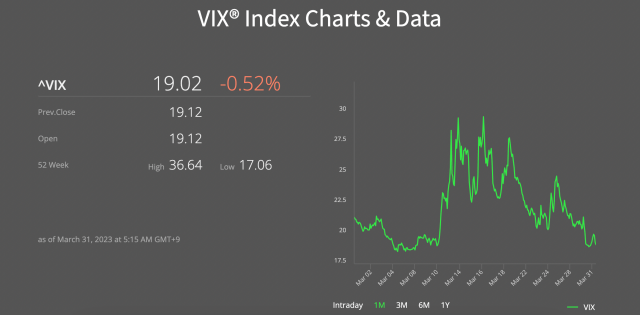

The fear index VIX (CBOE volatility index), which indicates a sense of caution about the future, temporarily dropped to the 18 level. The bank problem that occurred in the beginning of this month had pushed the index up to the 30 level in the middle of the month, but it has now returned to the level before the SVB bankruptcy. Investors seem to think the market is out of the worst of the turmoil.

Source: CBOE

IT/tech stocks were bought back as investors’ risk tolerance improved due to expectations of an interest rate cut within the year. Compared to the previous day for individual stocks, NVIDIA +1.4%, c3.ai +6.3%, Big Bear.ai -1.7%, Tesla +0.7%, Microsoft +1.2%, Alphabet -0.5%, Amazon +1.7%, Apple +1% , Meta +1.2%, Disney +1.2%, Coinbase -1.7%, Micro Strategy -1.6%.

On the other hand, although the near-term financial instability in US financial stocks has receded, investors are expected to continue to be reluctant as profits may be damaged by the tightening of regulations on banks in the future. On a day-to-day basis, JP Morgan -0.3%, Wells Fargo -1.5%, Bank of America -1.2%, First Republic Bank -4%, and Signature Bank -21%.

disney

The Walt Disney Company has fired Isaac Perlmutter, chairman and chief executive officer of Marvel Entertainment.

Perlmutter is known as the person who accepted Disney’s takeover offer in 2009 and created an opportunity to expand Marvel’s fan base. He has backed the activist shareholders who pressed Disney to reform its management.

It was also revealed that as part of cost cutting and organizational restructuring, the company has cut more than 300 employees engaged in video distribution services in China.

connection: US Disney dismantles Metaverse division as part of business restructuring = report

coin base

Coinbase has announced the appointment of Lucas Matheson as its “Country Director” for market expansion in Canada. He will oversee Coinbase’s Canadian efforts, having worked at Shopify and other Canadian financial giants.

O Canada!

We’re excited to announce the next phase of our international expansion from the Great White North.

Details here  https://t.co/YMpj6EjKfi

https://t.co/YMpj6EjKfi

— Coinbase (@coinbase) March 30, 2023

Coinbase Canada also signed a Pre-Registration Acceptance (RU) by Canadian regulators on March 24 (the deadline for increased regulation). “We continue to work with policymakers to develop a strong crypto regulatory framework for Canadians,” the company said.

In the background, OKX, Blockchain.com, and Deribit announced their withdrawal from Canada before the implementation of Canada’s tightening regulations. The long-established Kraken has submitted a pre-registration consent document and will comply with the new regulations.

connection: Professional analysis of Bitcoin derivatives market before major SQ | Contribution: Virtual NISHI

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

The post U.S. stocks continue to rise, U.S. quarterly GDP finalized downward | 31st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

131

2 years ago

131

English (US) ·

English (US) ·