BAYC downgrades OpenSea rating

Tiger Global Management, an American investment company that manages approximately $50 billion in assets, has significantly revised downward the stock valuation of its famous NFT collection “Bored Ape Yacht Club (BAYC)” and NFT marketplace OpenSea. It became clear.

This news was reported by Bloomberg based on information from multiple anonymous tipsters.

Specifically, it reduced the valuation of Bored Ape Yacht Club by 69% and the valuation of OpenSea’s stock by 94%. Overall, Tiger Global appears to have posted an 18% loss in the third quarter of 2023 (July-September). The ratings of AI-related company Superhuman and privacy search engine DuckDuckGo were also downgraded by 45% and 72%, respectively.

Tiger Global is a major institutional investor that raises capital from wealthy individuals such as pension funds, sovereign wealth funds, and Morgan Stanley. The company made more venture and private equity investments from the beginning of 2021 to the end of 2022 than in the previous eight years combined, according to PitchBook data.

However, in 2022, it reported a $23 billion valuation downgrade, reducing its venture fund valuation by about 33%. Furthermore, last November, it cut the value of its private funds by a quarter, with losses of 56% and 67% in hedge funds and long-only funds, respectively.

In June 2023, Tiger Global raised $2.7 billion for a private equity (PE) fund, which was only 45% of its $6 billion target.

connection:Aiming for “OpenSea 2.0,” cutting workforce by half, responding to drastic decline in market share, etc.

NFT market uncertainty impacts VC

These developments demonstrate how rising interest rates and market uncertainty are impacting startups and the venture capital industry, particularly the technology and crypto industries.

In early November, US high-tech investment management firm Coatue Management also cut the valuation of its OpenSea investment by approximately 90%, from $120 million to $13 million. OpenSea had raised $300 million in Round C in early 2022 with participation from Coatue Management at a valuation of $13.3 billion, but the current valuation is estimated to be less than $1.4 billion.

Meanwhile, OpenSea’s share of NFT marketplace transaction volume has declined from 73% to 18% in one year. In early November, company CEO Devin Finzer announced a 50% workforce reduction. He emphasized the company’s focus on transitioning to “OpenSea 2.0” and product upgrades.

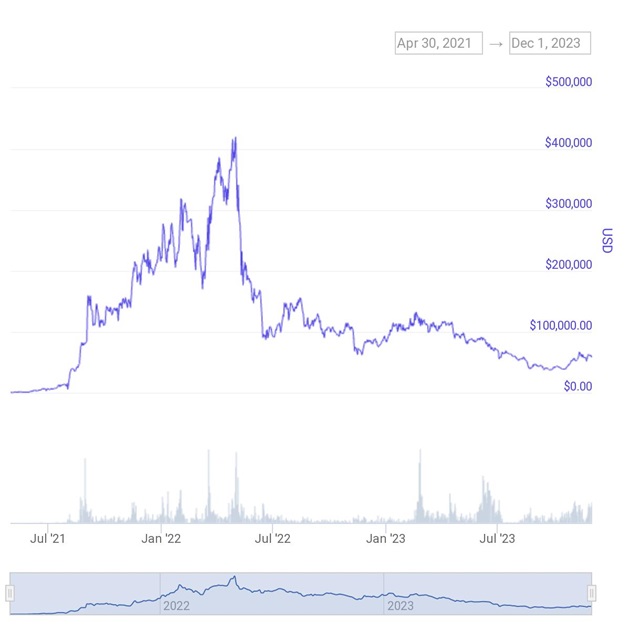

Bored Ape NFT publisher Yuga Labs also announced layoffs as part of its corporate restructuring. Yuga Labs has indicated that it will focus on strategy for the metaverse game “Otherside.” Bored Ape Yacht Club’s NFT floor price (minimum purchase price) has increased 60% in the past two months, but is down 30% year-over-year.

BAYC floor price trend Source: CoinGecko

connection:Yuga Labs cuts staff, restructures to focus on Metaverse

The post US investment company Tiger Global significantly lowers valuations of BAYC and OpenSea investments appeared first on Our Bitcoin News.

1 year ago

64

1 year ago

64

English (US) ·

English (US) ·